Loading...

Planning at retirement

Need access to plan resources and information? Find it below.

As you’re looking to make informed decisions about your retirement savings, you can use these tools as reminders of the value we provide, including our low-cost and highly competitive fee structure, comprehensive Plan services, and retirement planning tools and resources. The County of San Diego is committed to providing you with value, convenience and service from start to finish.

Plan information

Learn about the multiple investment options to help you plan for and live in retirement.

Prepare for retirement with this helpful guide, including information about rollovers and fees.

Learn about required minimum distributions and how they’re calculated.

Retirement planning resources

Review important contact information and reasons to stay with your deferred compensation plan.

Get answers to your questions about distributions.

Keep your important information in one place to make things easier for your loved ones.

Additional resources

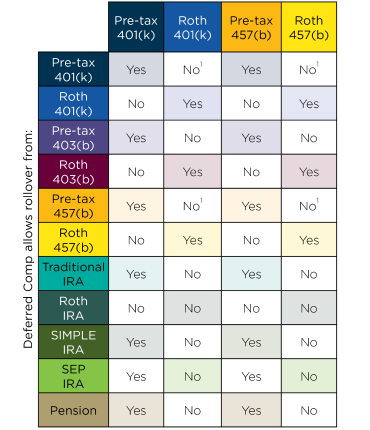

Deferred compensation rollover options

Did you know that you can roll over other retirement funds into your County of San Diego Deferred Compensation Program account? By doing so, you will benefit from the simplicity of having your funds in one place.

Terminal Pay Plan (TPP)

Consider rolling your Terminal Pay Plan payment into your Deferred Compensation account. If you retire or separate from service as a Tier I, Tier A or Tier B member with SDCERA, and you are at least 55 years of age or 50 for Deputy Sheriff (DS) or Sheriff Management (SM), then your accrued vacation balance may be paid through the TPP. You may roll over all or a portion of these funds into your existing Deferred Compensation account to defer taxes. You also have the option to receive all or a portion of your payment as a taxable distribution by direct deposit or check. To learn more, visit the Treasurer-Tax Collector’s webpage.

Retirement Resource Group includes Retirement Specialists and Personal Retirement Counselors. Retirement Specialists are registered representatives of Nationwide Investment Services Corporation (NISC), member FINRA, Columbus, OH. The information they provide is for educational purposes only and is not legal, tax or investment advice. Personal Retirement Counselors are registered representatives of Nationwide Securities, LLC., member FINRA, SIPC. DBA Nationwide Advisory Services, LLC. in AR, CA, FL, NY, TX, and WY. Securities and Investment Advisory Services offered through Nationwide Securities, LLC, member FINRA, SIPC, and a Registered Investment Advisor. DBA Nationwide Advisory Services, LLC in AR, CA, FL, NY, TX and WY. Representative of Nationwide Life Insurance Company, affiliated companies and other companies.